Monday, January 15, 2007

Housing Battle

Bill Miller, the famed-Legg Mason fund manager, was on television last week saying he is long housing stocks. In Barron's Up & Down column, Doug Kass of Seabreeze Partners was cited as being short the stocks--no big surprise there.

Kass referred to order cancellation as the reasoning for his bearishness. Typically, publicly traded homebuilders have cancellation rates of 15% of orders; however, that has jumped considerably.

Cancellation rates of publicly traded homebuilders:

Centex -- 37%

DR Horton -- 40%

KB Homes -- 53%

Lennar -- 31%

Pulite Homes -- 36%

Beazer -- 57%

Hovnanian -- 35%

MDC Holdings --49%

Standard Pacific -- 50%

These numbers are all provided by Kass, according to the Barron's article. These numbers are so bad that the worst might be unfolding right now.

TheFly's advice, Miller tends to be too early and Kass is often too negative when the worst is already priced in the stocks. Start following these stocks again, expecting a bottom in the spring and early summer.

The most recent rally is mostly from an oversold condition. Wait for another correction and see where the industry fundamentals stand.

Stock Shrinkage

In 2006, between private equity and share repurchases by US corporations, the amount of stock outstanding declined by a good chunk in 2006.

In a newsletter released this morning by investment strategist and portfolio Don Hays of Hays Advisory, there was $400 billion in cash takeovers this year by private equity and corporate mergers and acquisitions. In addition, there was over $600 billion of share repurchases.

This adds up to 3% shrinkage in the supply of stock available for purchase.There could be a lot more of this in 2007 as a whole host of US companies are generating a lot of excess cash that management will need to put to work. Home Depot (HD) is the poster-child stock for excess cash generation and share buybacks.

A good investment approach for 2007 might be to find companies like Home Depot with little debt that generates a lot of free cash flow and can afford big stock buy backs. Sooner or later demand will outstrip supply and drive stocks with these characteristics higher.

Wednesday, June 07, 2006

The Federal Reserve

Fed Chairman Bernanke's handling of the press has been anything but stellar since taking office. Hopefully he does a better job at handling the economy. He started off by confiding in the very ambitious Maria Bartiromo, assuming his comments were off the record, she rushed off to the studio and announced to the world that they were best friends and she would be the self-appointed mouth piece of the Fed.

However, if the Fed chairman wants to get back in good graces with the investment community, his best chance is to do what he says: make decisions that are data dependent and forward thinking. Do not base policy changes on rear-view-mirror data.

Employment

Recent economic data suggests the economy is slowing down. The employment data for May was simply awful. The economy created 75,000 jobs in the month, down from a few hundred thousand per month earlier in the year.

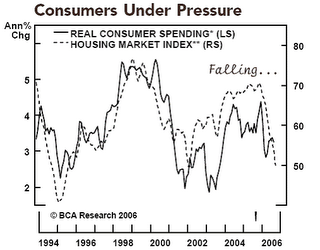

In addition, wage growth is virtually non-existent, with wages increasing $0.01 per hour in the month. That's right, if you work a 40 hour week, the average Joe and Jane got an increase of $0.40 for the week. I don't believe this covers the $20 increase in his or her gas bill. Take out a little extra for FICA, local taxes, some Fed taxes and now you are really living. The chart below clearly shows that real consumer spending has rolled over. The chart actually supports a view that the Fed should start lowering rates.

Housing Pricing Are Coming Down

The following chart paints a very clear picture: the supply and demand for housing is becoming increasingly imbalanced which is leading to a meaningful drop in prices. The chart shows the increase in the number of homes that are for sale, it clearly shows a big increase in inventory. As one would expect, this is leading to a nice decline in prices.

What Is The Fed Waiting For?

With employment growth now anemic, wage growth a joke and the house bubble now letting out a good amount of air, what is the Fed waiting for before it stops the increases?

Some suggest that the true measure of inflation and too much liquidity is the price of gold. However, even that is now coming down.

The substance of what Bernanki says after cutting through his inexperience at communicating publicly is pretty good. After the last FOMC meeting, he suggested that it might be the end of the rate increases, since Fed policy's impact can often lag. However, after gold started rallying, he panicked and started second guessing his comments.

If the new Fed chairman sticks to his initial instincts and the data, the Fed should be done for quite a while. From looking at the two charts above, along with a lot of other data, the Fed should be ready to lower rates by October. However, does Mr. Bernanke have the confidence to do this and not wait for the data to become much worse before he stops raising rates? From the recent drop in stock prices, the market is saying he does not have that confidence and will continue raising rates.

Monday, June 05, 2006

Don't Forget About Yahoo!

There were even reports a few weeks ago that Microsoft executives have explored the idea of buying a stake in Yahoo!. Heck! Why not buy the whole company? When you dig into the numbers, it may not be a bad idea:

Yahoo! Market Cap. = $ 49.0 Billion

Less: Yahoo! Japan Stake = $ 12.4 Billion

Less: Alibaba (Chinese Portal) = $ 1.4 Billion

Less: Cash - Debt = $ 2.0 Billion

Enterprise Value = $ 33.2 Billion

Yahoo! is expected to generate 2005 EBITDA of $2.0 billion and 2006 EBITDA of $2.6 billion. A 16.6x multiple for 2005 and 12.8x multiple for 2006---not that expensive for a high growth company.

Microsoft has failed in almost every Internet business it has attempted to enter. Yahoo! and Google have destroyed them. And Barry Diller, the great programmer, now owns ask.com, and he plans to enter the search businesses in a big way.

Microsoft still has $34 billion in cash after the huge cash distribution to shareholders last year so it could pay cash. Yahoo! also generates margins that are better than many of the new businesses (outside of its core software business) that Microsoft is investing in. Yahoo! is also a cash generating machine like Microsoft.

While Silicon Valley despises the Redmond-based giant, a Microsoft deal could lead to a mass employee exodus, but the Yahoo! franchise name has already been built. In addition, as Yahoo!'s stock price suggests, Wall Street has not been overly enthusiastic about its performance recently.

Bill, this might be your last opportunity to become an Internet company. Let's see a hostile takeover.

Saturday, June 03, 2006

Revlon Corp: Follow Up

Revlon had six months of excellent performance going into May. The four years of restructuring that Stahl has been part of was beginning to working and it was picking up good momentum with its Vidal Radiance and Almay products. Sometime during the Spring, its competitors reacted to Revlon's success with a slash in prices to keep market share and create a price war.

While price wars are unpleasant, they often signal a bottom in an underperforming industry. Often when a mature industry gets stale, a new management team is brought in to rebuild one of the companies (as in this case with Revlon) and the others fall behind and react to market share losses with a drop in pricing. This is often a short term response (often about six months) driven by competitors weakness which is the result of not being focused on investing in new products.

What is happening with Revlon is almost exactly what happened in the hamburger price wars during 2002 and 2003 when investors thought that the big fast food chains were going to sell hamburger for $0.99 forever. However, from looking at McDonald's price chart, it was a great time to buy. This is most likely the case today for the cosmetics business. (McDonald's stock jumped from $14 to $35 when the price war ended.)

Revlon has done a lot of good things the last four years: restructured its balance sheet, re-invented old products, created new ones, come up with an entire new store format that has shown some success. Well-placed business investment wins out over competing purely on price over time.

Also, remember that it would be cheaper for a competitor to buy Revlon than continuing this price war. A competitor could easily afford paying a big premium for the stock to get access to its distribution network, product names and shelf space. I recommend staying with the stock and shareholders will be well rewarded. I thought Revlon could be a big bagger, but if not, it should get a nice take out price.

Tuesday, May 23, 2006

Disruptive Forces: The Internet vs. Cable TV

There was a very good article today on gigaOm.com by Robert Young titled "Back To The Future...For Broadcast TV. " Young writes about the disruptive force that cable TV was for the big broadcast networks which is now repeating itself as the Internet disrupts cable TV.

The premise behind his argument is that as on-demand changes viewer habits, both due to the evolution of the Internet and more interactive cable TV services, viewers can more clearly decide what and when they want to watch something. This will place a lot of pressure on the marginally successful cable TV program and on its advertising revenue. Young concludes that there will be a shrinkage of programming, and subsequently cable TV channels, as advertisers continue moving to more targeted advertising platform.

Programming will shift to the Internet as channels like Myspace.com, YouTuBe.com, Veoh and Brightcove begin to gain a bigger audience.

For those of you who do not spend a lot of time on the Internet, it is worth seeing where the future is by looking at these websites. You might not like it, but it is the future.

Friday, May 12, 2006

Cramer Likes AES Corp.

Monday, May 08, 2006

AES Follow Up

- International financial markets are finally willing to open up lending to AES-type of projects which are often located in emerging markets. It has been difficult getting deals financed during the last five or six years.

- Pricing and volume mix are good in many markets.

- AES continues to show it has built itself into a nice free cash flow machine.

- New construction prospects are picking up.

Despite the huge run up in emerging-economy stock markets during the last few years, the available financing for greenfield type of projects that AES normally does is just opening up. I mentioned in the April blog that 2006 earnings would be flat as it reinvests for growth in 2007 and going into 2008, but it appears 2006 might be OK. In addition, it appears management has greater confidence in its ability to complete some large projects during the next few years which will support management's outlook for double-digit earnings growth.

After the year-end conference call, it appeared that this stock might be dead money until the fall, but with Monday's earnings release and the announcement of some big projects, investors will have to get back into this stock now.

Friday, May 05, 2006

Revlon Corp: New Newsletter Idea

Today Mullane Asset Management issued a new newsletter on Revlon Corporation. Executives from Coca Cola joined the company in 2002 and their efforts are about to pay off.

Tuesday, May 02, 2006

Favorite Stock Idea For 2006: Oracle Corp. UP 20%

As short-term interest rates continue to rise in many parts of the world, cyclical earnings and commodities are the most exposed to a slowdown. Oracle's business is just beginning to pick up and has a number of years of earnings growth in front of it.

Level 3 Continues Industry Consolidation: Part 2

As a reminder, Level 3 has acquired WilTel, Progress Telecom, ICG Communications and announced the TelCove deal yesterday. This is a classic consolidation of an industry which came out of a bust period. As I wrote in the September 2005 and November 2005 newsletters, IP traffic is growing 70% per year while the demand for oil grows 2 to 3% per year.

With Level 3 up over 90%, investors are beginning to focus on the real growth industry.

Thursday, April 27, 2006

Newell Rubbermaid: More Details

Newell was our favorite newsletter idea going into 2005. As usual, I am often early with our investment ideas. However, what is especially attractive about Newell is that it has a market capitalization of about $8 billion which is small compared to other well-recognized franchise name companies such as Coke ($100 billion) and P&G ($192 billion). While some might argue that the franchise names of Rubbermaid, Graco and Sharpie do not compare with that of Coke's and P&G's, however, in the 1980's, Rubbermaid was viewed by the investment community as the Coke and P&G of its day.

What was interesting about today's results is that Mark Ketchum, a former P&G executive, was able to so quickly turn sales around. When Ketchem took the job he emphasized the need to focus on what the customer wanted and then target those products with marketing dollars. It appears he is off to a nice start. If Newell can get the diverse group of business going, this could be a $45 to $50 stock in a few years. This run is just starting.

Newell Rubbermaid: Great Results, More To Follow

Tuesday, April 25, 2006

Rumors of Consolidation Of The Online Business

In addition, the industry, at this stage of its life cycle, appears to be counter-cyclical. The online travel business seems to get more inventory when the economy is weak and there is an oversupply of hotel rooms and airplane seats. When things are good, the hotel companies and airlines like to book the customers themselves.

This weakness in the online business may prove the best time for the industry to consolidate. Interactive Corp. laid the foundation for a consolidation by spinning off Expedia and most likely would play the lead role. Henry Silverman, head of Cendant, is breaking his company up which owns online travel distribution businesses with well-known names Orbitz and Cheaptickets in the consumer space, in addition to Galileo which is a leader in the business online travel market.

Expedia, during its existence, has shown great financial metrics with high operating leverage. Combining two industry leaders could create a profit generating machine. The $900 billion world travel business will grow nicely as the global economy booms. Expedia has been growing its online business twenty percent per year. A consolidated online industry will give it more power and more profit potential for shareholders.

Thursday, April 20, 2006

Merck & Schering-Plough: The Worst Might Be Over

When Merck was pushed on its 10%-plus EPS growth, management indicated some confidence in its pipeline although did not want to discuss it in great detail. However, management did stick to the guidance provided in its December analyst meeting which should translate into EPS of $4.10 by 2010. Guidance appears to be based on modest revenue growth and cost controls.

From listening to a number of calls, virtually all of the old-line pharma companies expressed better confidence. A CNBC interview with Lilly's head mentioned that a lot of biotech projects initially funded in the 1990s might be coming to fruition.

It has been a tough decade for large pharma. There are hints that the worst is over. It is time to start looking at these companies again.

Intel: Simply Awful

- Revenue down 12% yoy

- Operating income down 49%

- Net income down 45%

- EPS down 43%

- Terrible guidance

Geography also hurt with Europe down 26% and Asia-Pacific (the world's fastest growth region) down 16%.

These numbers simply are awful. Intel holds an analyst meeting in New York next week. We will see if they bring anything new to the table.

Wednesday, April 19, 2006

JP Morgan Chase: Poor Fixed Income Results Might Portent Good Future

It is hard to imagine how the fixed income results for so many investment banks could be so good. Not since the 1980s and Bonfire of the Vanities with the iconoclastic Master of the Universe bond trader/investment banker Sherman McCoy or in the 1990s when the infallible John Meriwether and the Nobel prize-filled Long Term Capital, who took on risk-free positions with infinite leverage, have bond traders graced the headlines with such stardom and performance. Both the fictional McCoy and the not-so fictional Meriwether came back to earth. We will see if the outstanding fixed income results reverse and bring these big investment firms back to earth during the next few quarters.

Today's call was a refreshing reminder of why the investment community likes Jamie Dimon. He reiterated his position that he will not risk the company's balance sheet to chase the performance of the other major investment banks in fixed income. The bond bull market was very mature when Dimon took control of JP Morgan Chase and he is committed to not getting whipsawed. In addition, Dimon was pretty candid about the outlook on the consumer credit business which appears to be maturing in a number of different ways. Not only in terms of growth in balances but it also appears that as baby boomers age they are beginning to pay down their credit a lot quicker. My guess is this trend began to emerge in the middle of 2005.

To offset this weakness, JP Morgan Chase is going to focus on its branch network and appears to have a lead on the other money center banks in this regard. Growth in sales of mortgage origination, credit cards and other branch-related service were very strong. The company also announced it repurchased $1.6 billion of stock in the quarter and the board approved an $8.0 billion buyback going forward.

All told, JP Morgan's results were pretty solid and this stock has to be owned by portfolio managers who are concerned about what a bear market in bonds will do to the results of the other investment firms. This is Dimon's baby and he wants to prove he can do it on his own. It appears that he is taking a fundamentally sound approach.

Yahoo!: A Value Stock?

Investors should remember that Yahoo is down big from its peak price of $43.66 in January of this year, a 24% decline. This brought the market cap to about $49 billion. The company is expected to end 2007 with about $4.0 billion in cash on its balance sheet after adjusting for debt and owns a 34% stake in Yahoo! Japan worth about $12.4 billion. (Yahoo! Japan is doing very well against competitors in its market.) Take out another $1.4 billion for Yahoo's stake in Alibaba, the Chinese portal, and this brings you down to an enterprise value of about $31 billion. Wow! that is not the bubble valuation that I remember.

Take that $31 billion and compare that to an EBITDA estimate of $2.6 billion and you get an enterprise value to EBITDA valuation of 12x 2007 estimate. That's not too bad for a company growing its EBITDA 20% per year.

In the 1980s and 1990s that was the mid-valuation range for high-growth media companies such as wireless, cable and radio. Maybe CFO Decker was right to subtlely throw out some old-fashioned value-investor metrics.

Whether you want to classify Yahoo as a value stock or not, its operating performance for the quarter was solid. It is going to host an analyst day on May 7th at which time it is going to announce a new ad revenue model. It appears that Yahoo's management feels comfortable enough with its business model to make such an important change. In addition, management mentioned it was confident it can keep Yahoo growing for the next few years. There appears to be plenty of substance behind today's rally.

Tuesday, April 18, 2006

Level 3: Industry Consolidation Continues

SBC acquired AT&T's long distance business and Verizon has purchased MCI. Supply is becoming less and less as demand for capacity increases and increases.

Telecom reminds me of the housing industry in the 1990s. After the savings and loan crisis of the late 1980s, all the major home builders were on the verge of bankruptcy. Those who survived consolidated the industry during the next decade, making some 30x to 40x investor's money by the middle part of this decade.