Fed Chairman Bernanke's handling of the press has been anything but stellar since taking office. Hopefully he does a better job at handling the economy. He started off by confiding in the very ambitious Maria Bartiromo, assuming his comments were off the record, she rushed off to the studio and announced to the world that they were best friends and she would be the self-appointed mouth piece of the Fed.

However, if the Fed chairman wants to get back in good graces with the investment community, his best chance is to do what he says: make decisions that are data dependent and forward thinking. Do not base policy changes on rear-view-mirror data.

Employment

Recent economic data suggests the economy is slowing down. The employment data for May was simply awful. The economy created 75,000 jobs in the month, down from a few hundred thousand per month earlier in the year.

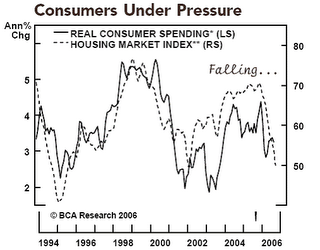

In addition, wage growth is virtually non-existent, with wages increasing $0.01 per hour in the month. That's right, if you work a 40 hour week, the average Joe and Jane got an increase of $0.40 for the week. I don't believe this covers the $20 increase in his or her gas bill. Take out a little extra for FICA, local taxes, some Fed taxes and now you are really living. The chart below clearly shows that real consumer spending has rolled over. The chart actually supports a view that the Fed should start lowering rates.

Housing Pricing Are Coming Down

The following chart paints a very clear picture: the supply and demand for housing is becoming increasingly imbalanced which is leading to a meaningful drop in prices. The chart shows the increase in the number of homes that are for sale, it clearly shows a big increase in inventory. As one would expect, this is leading to a nice decline in prices.

What Is The Fed Waiting For?

With employment growth now anemic, wage growth a joke and the house bubble now letting out a good amount of air, what is the Fed waiting for before it stops the increases?

Some suggest that the true measure of inflation and too much liquidity is the price of gold. However, even that is now coming down.

The substance of what Bernanki says after cutting through his inexperience at communicating publicly is pretty good. After the last FOMC meeting, he suggested that it might be the end of the rate increases, since Fed policy's impact can often lag. However, after gold started rallying, he panicked and started second guessing his comments.

If the new Fed chairman sticks to his initial instincts and the data, the Fed should be done for quite a while. From looking at the two charts above, along with a lot of other data, the Fed should be ready to lower rates by October. However, does Mr. Bernanke have the confidence to do this and not wait for the data to become much worse before he stops raising rates? From the recent drop in stock prices, the market is saying he does not have that confidence and will continue raising rates.